HOW TRADING FLOORS BEING CLOSED IMPACTS MARKET CLOSE

Background

Prior to COVID-19 trading floors at Exchanges had very effective processes for opening and closing the markets. This consisted of brokers on trading floors who understood their firm’s position and would buy or sell stocks to remove any large risk to the firm. These processes have been in place for years and reduced end of day spikes resulting in a smooth on-time close.

Problem Statement

Today, the Exchange trading floors remain closed/un-manned to prevent the spread of COVID-19. Brokers are working remote. This is more difficult for firms to change their position, buying and selling stocks to protect themselves from losses. In addition, Algorithmic trading identifies this as an opportunity and activity is increased at light speed creating significantly more activity in the market. What typically was a process that started at 2pm with face to face transactions till 4pm is now commencing electronically at 3:50pm with the same 4pm close deadline. A combination of broker, electronic transactions and squeezing the closing time from 2 hour to 10 minutes during this time creates large spikes in market trading volumes.

What this means to the financial industry

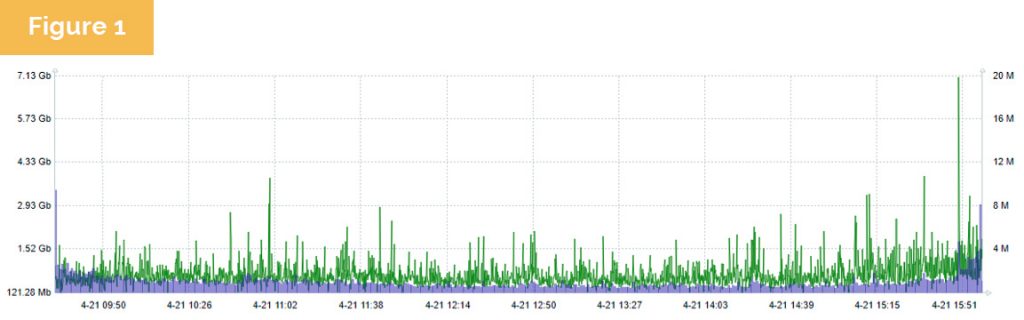

Our industry relies on market data getting from the market “Exchanges” to our clients in a fast and consistent delivery. Firms incur large expense to make sure that they have a robust delivery of this data. The chart (figure 1) below depicts a typical day of volume of trading activity since COVID-19.

The green line represents bandwidth in GB to the feed and the light purple represents trading volume.

What is observed in the data collected is that that volume (light purple) typically averages around 1-1.5MB of shares traded at any given time. The green line represents bandwidth to the vendor feed mirrors the behavior of market volume so when there is an uptick in volume there is a matching uptick in bandwidth consumption. From time to time there are spikes in volume which are related to company and market activities. Our clients market data infrastructures easily support this type of activity and throughput by design.

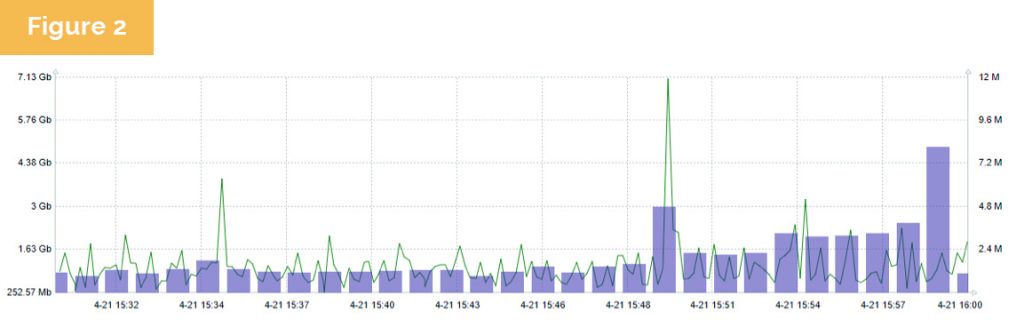

Due to this pandemic resulting in normal activities being reduced from 2 hours to 10 minutes the trading activity and volumes have seen significant increases that have created a tremendous volatility and sustained increases during that time which has a downstream effect on the market data platforms. The chart (figure 2) below shows the impact on volume at 3:50PM that is seen consistently since COVID-19.

Figure 2 – Zoom in of 3:50PM EST until 4:00PM EST Market Close. Green line represents bandwidth in GB to the Feed and light purple represents volume of shares traded.

What is consistent here is the impact of market data volume on the amount of bandwidth consumed for a typical market data backbone. Exactly at 3:50PM (and up to 8MB at close) volume surges from <1MB to 4.8MB or between 3-4 times more of the typical trading volume. The resultant impact to bandwidth consumption is the same 5-7 times more bandwidth being consumed. Many environments fail and disconnect consumers from receiving market data and/or updates at this time which negates the firm’s objective of risk mitigation during this 10-minute window.

How West Highland helped to identify this issue and the impact to our clients & the industry

Leveraging our A.L.I.V.E. (Application Latency Indicator for Vendors and Exchanges) Solution and Data Science practice we capture our client’s throughput each day. A.L.I.V.E. programmatically overlays these findings with the market volumes we’ve captured in real time.

This information identified a clear pattern that confirmed market conditions at 3:50PM EST due to new exchange behavior had a direct impact to the client’s infrastructure and trading environment.

West Highland has a unique ability to look across all components of the client’s market data delivery system from the time it enters the building to when it reaches its final destination, the applications that drive the business. West Highland has been collecting this data and correlating its impact to client environments for over 20 years.

We identified 5 areas of impact that could cause an outage putting the firm at a disadvantage in the market.

These areas were:

- Saturated client circuits

- Saturated client / market data network

- Resource issues on market data servers

- Software delivering, consuming market data

- Not having the best tools / monitoring to capture these events

If your market data environment is having these or other issues, please contact us. For more information or to schedule a call please contact us at sales@westhighland.net.