EXECUTIVE SUMMARY

Market data vendors send invoices totaling over $33 billion per year to MDS administrators at some of the most technically advanced financial institutions in the world. However, most of these invoices are processed manually because of the myriad of disconnected systems used in the complex accounts payable process. This results in processing times that can be up to 30 days, increased errors resulting in over payment or late fees and overall reduction in time spent on detailed analysis of usage and vendor selection which should be the true focus of the highly skilled business analysts at your organization. This white paper is focused on helping you define an invoice automation strategy at your firm by leveraging Robotic Process Automation (RPA) tools that support open standards and complex global workflows.

I LOVE PROCESSING INVOICES… WAIT!

One of the most rewarding part of any market data professional’s job has got to be processing invoices. Confirming pricing; validating account numbers; handling exceptions – wait, you want me to handle magazine subscriptions now too. Can it get any better than this?

In all seriousness, our clients are experiencing significant challenges in managing the growing number of vendors and invoices flooding into their organizations. The issue often begins with the first step in the process, namely receiving and entering the invoice into the appropriate system and identifying the correct account and allocation targets.

EYE-OPENING INVOICING STATS

Large banks typically receive several hundred market data related invoices per month. The average cost of processing a typical market data invoice is $40. Average processing time is 8.6 days with some firms taking 25-30 days to process a single invoice.

Manual data entry into associated inventory and accounts payable (AP) systems incurs a 10% error rate on market data invoices. Error handling adds to the overall complexity of the workflow resulting in 58%(1) of companies paying late fees on a regular basis.

In addition to late fees these issues often lead to significant backlogs which reduce the time available for a more detailed analysis of the bill. For example, 63%(1) of companies report receiving duplicate invoices and 33%(1) of these firms report actually paying them! Because of these types of challenges AP staff spend 24%(2) of their time finding and fixing billing errors.

Accounts Payable departments using automation experience 57%(3) lower exception rates than other enterprises and 5 times faster(2) invoice processing time.

(1) ap association

(2) Corcentric

(3) Community Dynamics

MDS SPEND RISING FAST

Financial Market Data spending accounted for a record $33.2 billion In 2020(4), rising 5.9% from the previous year. While real-time market data and trading accounted for the largest share of total revenues, strong demand for pricing, reference and valuation data drove much of the growth.

Average spend for large sell-side firms is around $200 million compared to $50 million for the buy-side. Even small investment banks see market data charges of close to $80 million per year.

Average spend for large sell-side firms is around $200 million compared to $50 million for the buy-side. Even small investment banks see market data charges of close to $80 million per year.

Typically, the top 5 vendors (Refinitiv, Bloomberg, Factset, IHS Markt, and S&P) account for 80% of overall spend. Exchange fees usually account for 25% of the total spend. Our research shows that approximately 5% of this spend is for services that are not used at all. Internal and client allocations account for around 75% of the spend and is often manually assessed though complex and tedious usage analysis that is performed to allocate the cost of almost every market data invoice.

Market data business analysts focused on these manual processes are not focusing on driving unnecessary costs out of the organization or improving services for their clients and users.

(4) PR Newsire

WHY AUTOMATE

Automation has improved almost all aspects of our working lives. But it’s still an investment (although one that will pay for itself). Our analysis suggests that firms can save three hours every day or 780 hours a year by automating their market data AP process. So, let’s look at why you need to consider automation for your market data team.

WELL IMPLEMENTED ACCOUNTS PAYABLE AUTOMATION

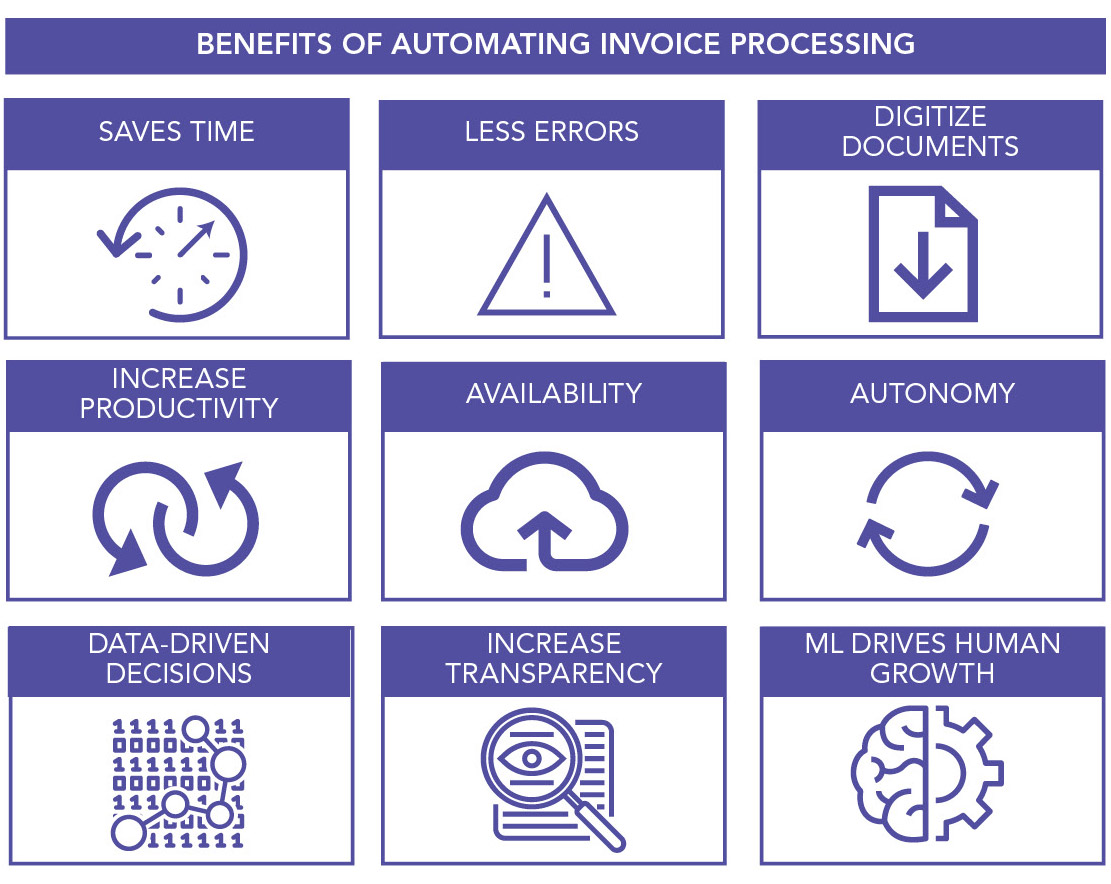

Saves Time

What was previously tedious and repetitive work like transferring data between systems, checking purchase orders and contract terms is now done and tracked automatically.

Leads to Fewer Errors

Humans tend to make mistakes the more manual a complex task is, while computers can repeat them endlessly and without fault.

Digitize documents by default

While most invoices received at financial institutions are now received electronically these are still treated in a very “paper-like” manner. RPA automates the task of receiving, categorizing, elementizing, validating and tracking the invoice as it moves through the AP process.

Increases Productivity

So, what do we do with all that extra time not wasted on these tedious tasks? Improve business by identifying new sources of strategic content, reduce costs through aggressive analysis of usage patterns, improve compliance by having a close relationship with end users and development teams, improve service through tighter alignment with delivery teams and vendors.

Makes Accounts Payable Accessible from Anywhere

Manual processes often need to be done in a central location to assure access to all relevant information including legacy paper contracts. An automated invoice processing solution enables a cloud-like experience, allowing analysts to work from anywhere with an internet connection!

Gives Autonomy to Other Teams

A well-designed automated AP solution increases transparency and takes advantage of self-service features that will empower your users and managers to take responsibility for their market data spend.

Collecting Data and Getting Better Insights

For years market data teams have been talking about the power of big data and analytics, but few MDS teams have really embraced a data driven approach to expense management. Robotic Process Automation and Machine learning make it easier to harness the power of big data to drive your AP operations. You may be able to identify patterns that could help in vendor choice or improve your approach to negotiations as well as opportunities to reduce cost by changing payment terms with select vendors.

Increase Your Control and Transparency

What is happening with that invoice? When your processes are all manual and invoices are handled in a linear manner the status of each invoice is usually a data point in the back of someone’s mind or on a yellow post-it note. An RPA invoice processing system can also show you how productive your team is, in real-time.

Machine Learning Services Help You Grow

It should be clear by now that RPA and machine learning can help your business achieve many of its goals. It can also help you scale your operations without adding staff as you take on more responsibility or workloads increase unexpectedly. It can also reduce expenses, which frees up capital to invest in other parts of your business to fuel growth.

CURRENT SPEND MANAGEMENT (INVENTORY) TOOLS

The inventory management tools used by many market data groups are quite powerful but have done little to simplify the process of managing and reducing your market data costs. Administrators spend countless hours transferring data between systems, manually handling the exceptions often caused by the inflexibility of these “one-size fits all systems”. In recent years these vendors have added premium priced services and modules for invoice handling but many clients have yet to adopt these services in significant numbers because of price and the limitation of the solution.

We would argue that true automation must not be looked at as a point solution but is an evolutionary shift in your approach to the workflow. Most banks and buy-side firms are engaged in large digital transformation programs that are breaking the old approach to monolithic siloed systems. Our most innovative clients are choosing powerful Open RPA platforms that are designed to interface with any internal and 3rd party software platform to enable “hyper-automation” across their entire enterprise instead of a vendor specific point solution that could use automation to lock you into that vendor’s product.

We would argue that true automation must not be looked at as a point solution but is an evolutionary shift in your approach to the workflow. Most banks and buy-side firms are engaged in large digital transformation programs that are breaking the old approach to monolithic siloed systems. Our most innovative clients are choosing powerful Open RPA platforms that are designed to interface with any internal and 3rd party software platform to enable “hyper-automation” across their entire enterprise instead of a vendor specific point solution that could use automation to lock you into that vendor’s product.

WHAT THE INDUSTRY NEEDS TO AUTOMATE INVOICE PROCESSING

Open Platform

The automation platform must be an open architecture, free from vendor specific and isolated modules. The platform must enable the full automation of the market data services workflow including user on-boarding, administration, off-boarding, contract, PO, invoice, and AP.

Limitless Connectors

A core automation platform must support as many 3rd party connections and APIs as possible. This will insure that your workflow solution will be robust and can adapt to changes in process, policy, and SaaS solutions.

Immediate Feedback and Exemption Flagging

Exception handling is a critical activity and must be managed through the automated workflow and not be “kicked-out” of the automated process. This will assure consistency, transparency and proper data collection that can be used to improve the workflow process.

Automated Exemption Handling

Even complex exemptions can be automated if your system’s framework is designed correctly. Use detailed analysis of exemptions to automate as much of the sub-workflow and leave only complex issues to your analysts.

Empower Your Team to Step-Up Their Game

Once most of the workflow of invoice processing has been automated, challenge your team to use data and analytics to dig into the spend and drive costs out of your organization through usage analysis and alternative data sourcing.

GETTING STARTED WITH ROBOTIC INVOICE PROCESSING

West Highland Support Services helps clients in the banking and financial services industry define and implement their automation strategy; enabling an agile approach to identifying RPA/AI candidates to quickly reap the benefits of these powerful technologies. WHSS helps our clients with assessing internal processes, establishing a formal proof-of-concept for each use case, recommending the most suitable tools, as well as working with all client stakeholders to implement and operationalize our RPA solution.

ABOUT WEST HIGHLAND SUPPORT SERVICES

West Highland Support Services is a vendor-agnostic managed service provider, recognized globally as an industry authority and thought partner for market data, referential and professional services for over 20 years.

West Highland is referred to as “The Gold Standard” for managing, installing and architecting robust market data platforms. We continue to lead the industry with innovative tools and services that increase visibility, manage capacity and maximize uptime while reducing overall operating expense.